Curriculum

- 17 Sections

- 17 Lessons

- Lifetime

- Lesson nr. 11

- Lesson nr. 21

- Lesson nr. 31

- Lesson nr. 41

- Lesson nr. 51

- Lesson nr. 61

- Lesson nr. 71

- Lesson nr. 81

- Lesson nr. 91

- Lesson nr. 101

- Lesson nr. 111

- Lesson nr. 121

- Lesson nr. 131

- Lesson nr. 141

- Lesson nr. 151

- Lesson nr. 161

- Lesson nr. 171

Short and Long Positions: Mastering the Basics of Forex Trading

- Academic FX

- Beginners Course

Welcome back to your educational journey with AcademicFX! As you advance in your understanding of Forex trading, it’s essential to grasp the concepts of short and long positions. These terms describe the direction of your trades and are fundamental to your trading strategy. In this article, we’ll explore what short and long positions are, how they work, and their significance in the Forex market.

Understanding Long Positions

What is a Long Position?

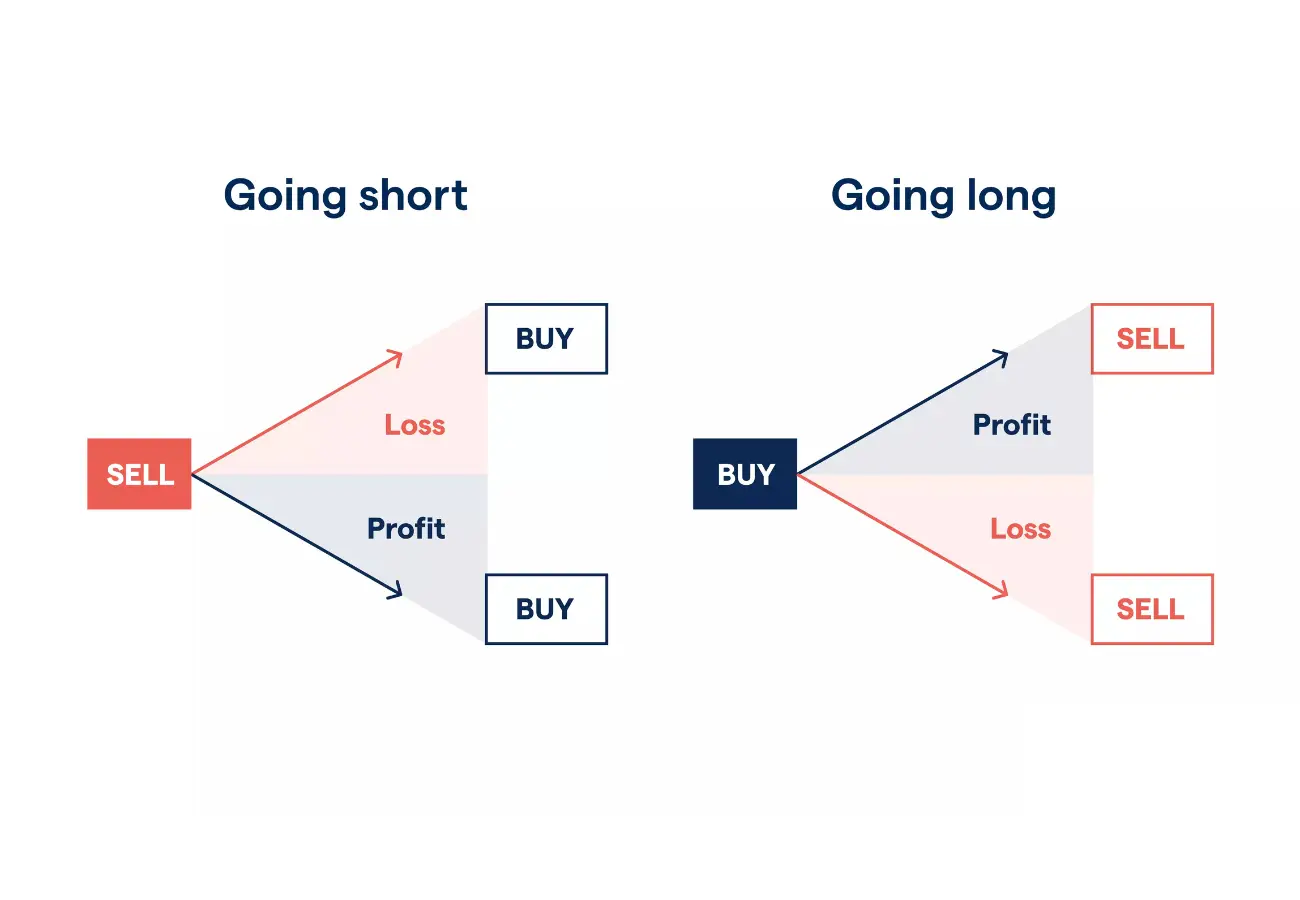

A long position in Forex trading means that you are buying a currency pair with the expectation that its value will rise. When you go long, you are essentially betting that the base currency will strengthen against the quote currency.

Example:

- If you take a long position on the EUR/USD pair, you are buying euros and selling US dollars, anticipating that the value of the euro will increase relative to the dollar.

How Long Positions Work

To take a long position, you buy a currency pair at the current market price (ask price). If the price rises, you can sell the pair at a higher price to make a profit. Conversely, if the price falls, you will incur a loss.

Example:

- You buy EUR/USD at 1.1200. If the price rises to 1.1300, you can sell your position for a profit of 100 pips. If the price falls to 1.1100, you would incur a loss of 100 pips.

Understanding Short Positions

What is a Short Position?

A short position in Forex trading means that you are selling a currency pair with the expectation that its value will fall. When you go short, you are essentially betting that the base currency will weaken against the quote currency.

Example:

- If you take a short position on the EUR/USD pair, you are selling euros and buying US dollars, anticipating that the value of the euro will decrease relative to the dollar.

How Short Positions Work

To take a short position, you sell a currency pair at the current market price (bid price). If the price falls, you can buy the pair back at a lower price to make a profit. Conversely, if the price rises, you will incur a loss.

Example:

- You sell EUR/USD at 1.1200. If the price falls to 1.1100, you can buy back your position for a profit of 100 pips. If the price rises to 1.1300, you would incur a loss of 100 pips.

Key Considerations for Long and Short Positions

Market Analysis

Successful trading requires thorough market analysis, whether you are taking a long or short position. This includes both technical analysis (using charts and indicators) and fundamental analysis (considering economic data and news).

Example:

- Before taking a long position on EUR/USD, you might analyze charts for bullish patterns and review economic indicators such as Eurozone GDP growth or US interest rates.

Risk Management

Proper risk management is crucial when trading long or short positions. This includes setting stop-loss orders to limit potential losses and using appropriate position sizes to avoid over-leveraging your account.

Example:

- If you take a long position on EUR/USD, you might set a stop-loss order at a level where the price has shown support, limiting your potential loss if the trade moves against you.

Trend Identification

Identifying market trends can help you decide whether to take a long or short position. Uptrends typically favor long positions, while downtrends favor short positions.

Example:

- If the EUR/USD pair has been in an uptrend, you might look for opportunities to go long. Conversely, if it has been in a downtrend, you might look for opportunities to go short.

Practical Application

Using Orders

There are various types of orders you can use to execute long and short positions, including market orders, limit orders, and stop orders. Each type of order has its own advantages and is suited to different trading strategies.

Example:

- A market order executes immediately at the current bid or ask price. A limit order sets a specific price at which you want to buy or sell. A stop order becomes a market order once a specified price is reached.

Leveraging

Leverage allows you to control a larger position with a smaller amount of capital, but it also increases your risk. Understanding how to use leverage responsibly is critical for managing both long and short positions.

Example:

- If you use 50:1 leverage to take a long position on EUR/USD, a 2% move in the price can result in a 100% gain or loss on your capital. Use leverage cautiously to avoid significant losses.

Conclusion

Mastering the concepts of short and long positions is fundamental for any Forex trader. By understanding how to take and manage these positions, you can effectively participate in both rising and falling markets. Remember to combine thorough market analysis with prudent risk management to enhance your trading success.

Stay tuned for more educational content as we continue to explore the dynamic world of trading with AcademicFX. Happy trading!

Tags :