Dow Jones Today: Nvidia Surge Propels Nasdaq Higher; Rising Treasury Yields Trip Up Dow

- Academic FX

Live Nation Entertainment (LYV) shares experienced a significant drop during intraday trading on Thursday following the Department of Justice (DOJ) filing an antitrust lawsuit against the Ticketmaster parent company, potentially leading to its breakup.

The lawsuit alleges that Live Nation and Ticketmaster hold monopoly power, violating Section 2 of the Sherman Antitrust Act.

“As a result of its conduct, music fans in the United States are deprived of ticketing innovation and forced to use outdated technology while paying more for tickets than fans in other countries,” stated the DOJ in a press release. “Additionally, Live Nation-Ticketmaster exercises its power over performers, venues, and independent promoters in ways that harm competition.”

Reports from Bloomberg late Wednesday indicated that the DOJ, along with a group of states, planned to file the lawsuit in the Southern District of New York. This news sent Live Nation shares tumbling in extended trading. The Wall Street Journal had also reported on potential litigation back in April.

As of early Thursday afternoon, Live Nation shares had fallen more than 6%, making it the worst-performing stock in the S&P 500.

DuPont Announces Plans to Split into Three Public Companies, Names New CEO

DuPont (DD) announced on Wednesday its plans to split into three separate publicly traded companies, spinning off its electric and water businesses.

The DuPont name will continue to represent its industrial segment, while the water and electronics operations will become independent companies focused on their specific markets.

This separation is intended to enable the resulting companies to better allocate capital and pursue merger and acquisition opportunities.

“At separation, each of the three companies will have strong balance sheets, attractive financial profiles, and compelling growth opportunities,” DuPont said in a press release. The company expects the separations to be completed within 18 to 24 months.

DuPont also announced that its chief financial officer, Lori Koch, will assume the role of chief executive in June, overseeing the spinoffs. Koch will replace Ed Breen, who will continue as executive chairman.

DuPont shares were up 0.2% late Thursday morning, with a year-to-date gain of just over 2%.

Where is Nvidia Stock Price Headed After Post-Earnings Pop?

Shares of artificial intelligence (AI) leader Nvidia (NVDA) surged more than 6% in extended trading on Wednesday after the company released another stellar quarterly earnings report and announced a 10-for-1 stock split. With the stock surpassing the significant psychological $1,000 level, here’s what the chart suggests for its future direction.

Nvidia shares have maintained a long-term uptrend since the 50-day moving average (MA) crossed above the 200-day MA in late January of last year, forming a bullish golden cross buy signal. Buyers have consistently snapped up minor retracements over the past 14 months.

Interestingly, trading volumes have decreased since the stock reached its record high of $974 in early March, indicating that larger market players have stayed on the sidelines ahead of the AI chipmaker’s fiscal first-quarter report.

On Thursday morning, the stock broke out from a three-month consolidation period to a new all-time high (ATH), suggesting the shares could continue their longer-term upward movement. Investors can project a future price target using a measured move. For example, adding $210 to Wednesday’s $970 closing price projects a target of $1,180.

For those hesitant to chase breakouts, look for pullbacks to the top trendline of the consolidation period, which will likely flip from a prior resistance area into support.

Stocks Making the Biggest Moves Premarket

Gains:

- Nvidia (NVDA): Shares of the AI chip giant jumped more than 6% after reporting another quarter of exceptional earnings and announcing plans for a 10-for-1 stock split.

- Snowflake (SNOW): The cloud-computing company’s shares rose over 4% after it raised its full-year sales forecast amid strong demand for its AI offerings.

- Toronto-Dominion Bank (TD): Shares of the Canadian bank increased 2% after it beat first-quarter revenue and adjusted earnings estimates, driven by strength in its primary Canadian business.

Losses:

- VF Corp (VFC): Shares of the Vans and Supreme owner fell 8% after posting a fiscal fourth-quarter loss amid a prolonged slump in apparel demand.

- GlobalFoundries (GFS): Shares of the chipmaker declined 8% after pricing a secondary public offering of $950 million of stock sold by its largest shareholder, Mubadala Technology Investment Company.

- Live Nation Entertainment (LYV): Shares dropped 5% after Bloomberg reported the Department of Justice’s plans to file an antitrust lawsuit against the Ticketmaster parent.

US Stock Futures Rise on Nvidia Earnings 'Halo Effect'

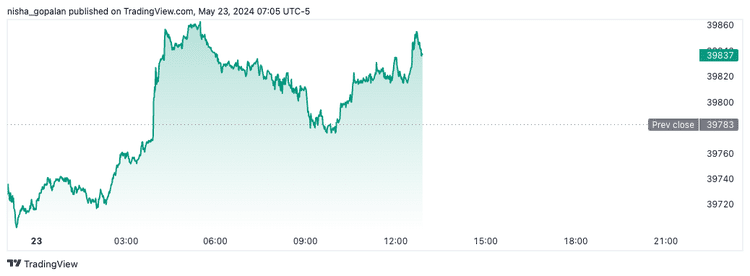

Dow futures were up 0.1% in premarket trading Thursday.

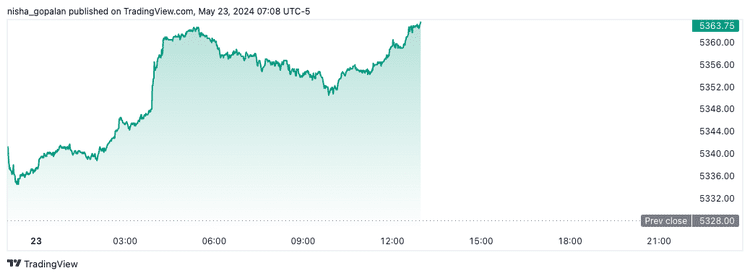

S&P futures were up 0.7%.

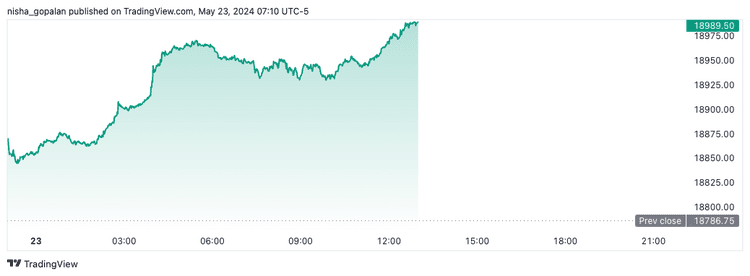

Nasdaq futures were up 1.1%.

Tags :

AcademicFX, Dow Jones, Nvidia