Dow Jones Today: Stocks Move Higher as Investors Await Clues on Rate-Cut Timetable

- Academic FX

U.S. stocks moved higher Monday morning, after major indexes closed last week at record highs amid optimism that the Federal Reserve could be in a position to start cutting interest rates soon.

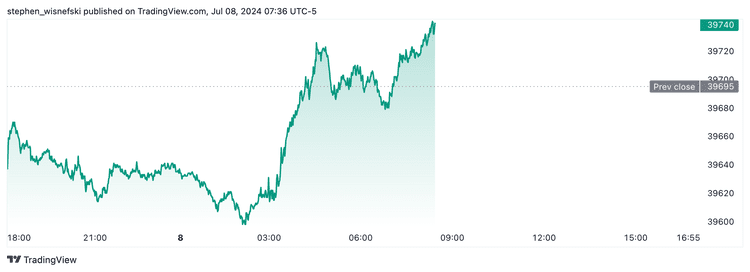

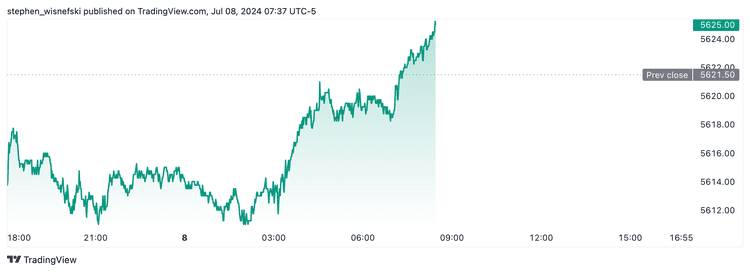

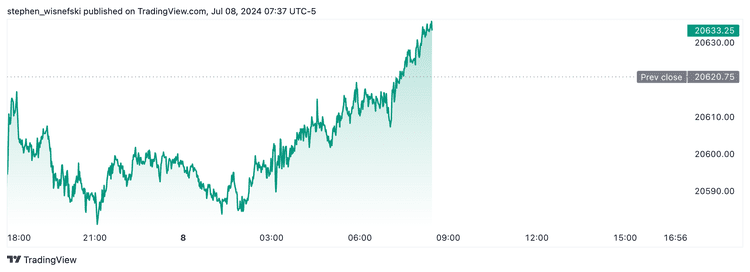

The Dow Jones Industrial Average was up 0.5% in early trading, while the S&P 500 and Nasdaq Composite each gained 0.1%. The S&P 500 and Nasdaq both finished at record highs on Friday, after rising 1.9% and 3.5%, respectively, for the week.

Investors are eagerly awaiting more information that could shed light on the Fed’s timetable for rate cuts, after jobs data on Friday boosted expectations that the central bank could move to do so as soon as September.

The first opportunity comes Tuesday, when Fed Chair Jerome Powell starts two days of testimony before Congressional committees. Later in the week, the first readings on June inflation will be released, providing an indication of whether price pressures have continued to moderate. Fed officials have said repeatedly they need to see more evidence that inflation is under control before moving to cut the benchmark federal funds rate.

The yield on 10-year Treasury’s was slightly higher Monday morning, at around 4.28%, after falling last week as investors placed bets that interest rates will be cut.

Among stock gainers Monday morning, Nvidia (NVDA) rose 2% following analyst upgrades, while Corning Inc. (GLW) was up 9% after the glass maker raised its sales and earnings guidance.

Paramount Global (PARA) was among the big decliners, losing more than 5% following news the company has agreed to merge with Skydance Media in a deal that ends months of negotiations between principals and offers a lifeline to the struggling media company.

Telsa Shares Down After Last Week's Big Gains

Tesla (TSLA) shares were down more than 2% in early trading Monday, after a 27% surge in the EV maker’s share price last week drove the stock back into the green for the year. The rally followed a better-than-expected second-quarter deliveries report and building anticipation ahead of the company’s Robotaxi Day next month.

Last week, Tesla shares closed above both the 50- and 200-week moving averages and a prominent 12-month downtrend line on the highest trading volume since mid-February, indicating buying conviction among market participants.

Tesla shares may encounter resistance on the weekly chart at $299.29, $384.29, and $414.50, while potentially finding support around $205.

Stock Futures Edge Higher

Futures contracts connected to the Dow Jones Industrial Average were up 0.1%

S&P 500 futures were also up 0.1%.

Nasdaq 100 futures were up 0.1%.

Tags :

AcademicFX, Dow Jones